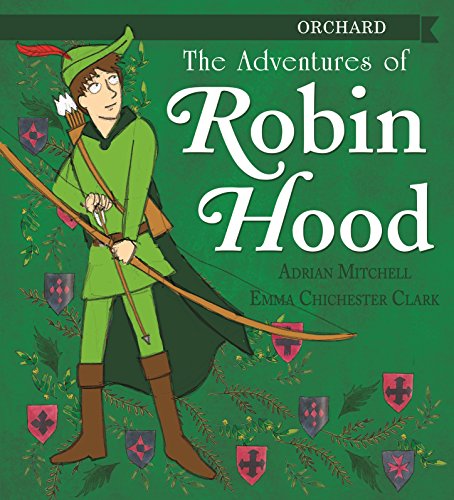

It was one my favourite books and character to read about .

It was only when I saw the movie year later that I realised how it was connected to finance !

When Price John becomes the King of England following the capture of his brother, one of the first things he does is raise taxes to become more wealthy. This causes the Saxon populace to become resentful against the new King, and allows Robin to find a common cause to unite his band of merry men.

So who still thinks the topic of taxation is not worth paying attention to !

The 4 largest types of direct taxes in Uk are –

Income tax forms the single largest source of revenues collected by the government. The second largest source of government revenue is National Insurance Contributions. The third largest source of government revenues is value added tax (VAT), and the fourth-largest is corporation tax

The government keeps tweaking these for various reasons !

A lot of students earn doing part time or odd jobs so its key to understand the 2 main taxes they pay

- Income Tax to be paid if you earn more than £12,570 per month- this is your Personal Allowance

- National Insurance to be paid if you earn more than £190 a week

Your employer will usually deduct Income Tax and National Insurance from your wages through Pay As You Earn (PAYE).

Jeremy Hunt our current finance minister is due to make his showpiece annual fiscal speech on March 6 and is widely expected to cut taxes to help boost the fortunes of Prime Minister Rishi Sunak’s Conservative Party ahead of election that is likely to be held later in 2024.

They have already reduced NI this year. From the 6th January 2024, the main Employee National Insurance (NI) rate was cut by two percentage points. So, for an employee in the default NI category, Class 1 National Insurance Contributions (NICs) are being reduced from 12% to 10%

Let’s hope the tax cuts out extra money in our parents and our pockets very soon !

See how the story and Lessons form Robinhood are still relevant in this age and time !!

Leave a comment