From inside the corner office at Lehman Brothers to secret meetings in South Korea, and the corridors of Washington, Too Big to Fail is the definitive story of the most powerful men and women in finance and politics grappling with success and failure, ego and greed, and, ultimately, the fate of the world’s economy.

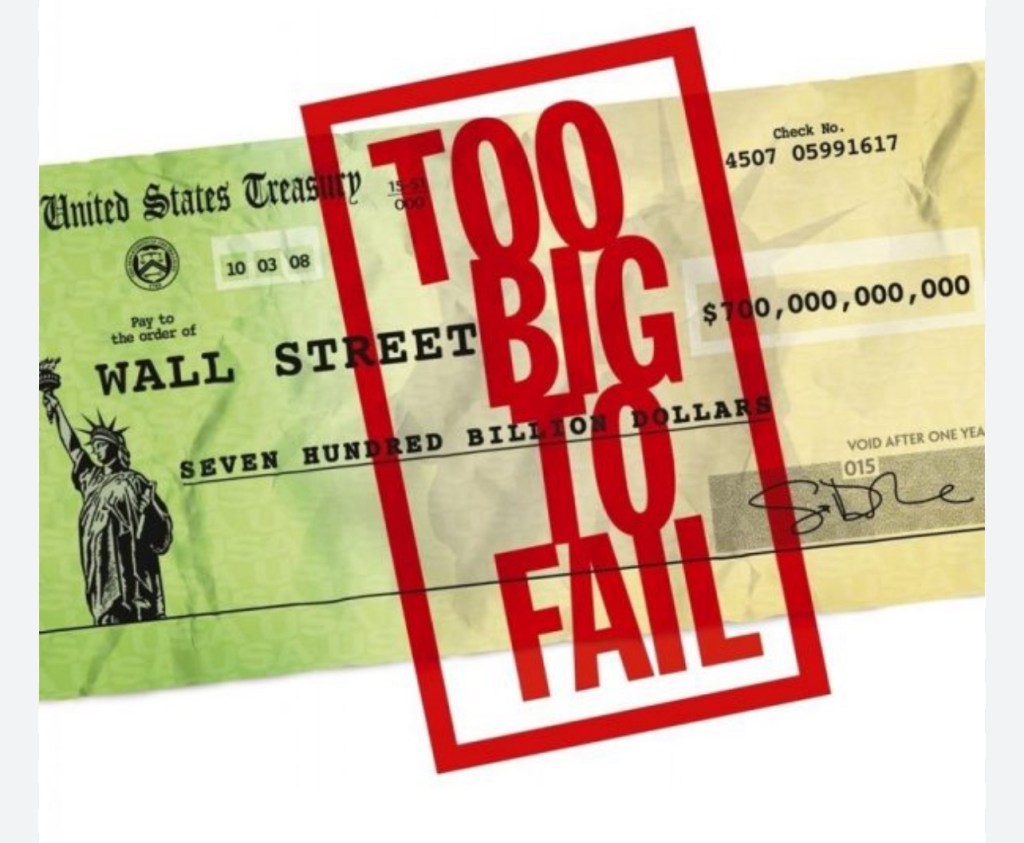

In 2008 some big banks were bailed out, for fear that allowing a big bank to fail would have a dangerous ripple effect, that could cause complete economic collapse of the world economy. Too big to fail means that the government firmly believes they cannot afford to let a big corporation go bankrupt

And what this means for us is that while we need to be careful where we park our money 💰 we should feel safe to have a bank account and be able to save our hard earned money there knowing it will be safe!

The main protection is from the Financial Services Compensation Scheme (FSCS). It was set up to cover people’s savings in the event that a bank were to go bust.

The FSCS protects 100% of the first £85,000 you have saved, per UK-regulated financial institution (not per account).

What this means is that if your bank were to fail, the FSCS aims to get any savings up to this amount back to you within seven working days.

Now you would be lucky to reach £85,000 but that should not stop you from having a bank account and this is what this post is about . I will focus on accounts for 16 year olds as I have one myself.

Hitting your 16th birthday opens all sorts of doors. In the UK, this is the age you receive a National Insurance number, can ride a 50cc moped, have a beer or wine with your meal in a restaurant, and order your own passport. When it comes to your money, it’s also the threshold for finally being able to open a bank account without your parent or guardian’s permission. You’ll be able to pay for things with card, withdraw cash and even earn interest on your savings

In the UK, many banks offer specific accounts tailored for 16-year-olds. These accounts typically come with features like a debit card, online banking, and sometimes additional perks like discounts or rewards. Examples include Santander 1|2|3 Mini Current Account, NatWest Adapt Account, Barclays Young Person’s Account, and HSBC MyAccount. Each bank may have different eligibility criteria and features, so it’s worth comparing options to find the best fit for you.

I have Santander account and I love having it

It gives me Monthly interest of 3% AER on my deposit of up to £2,000 as of writing this blog, this is £5 per month and pays for phone bills.

I try to save from my pocket money and move it into the account when possible and am looking forward to using it to get my summer job salary into it aswell.

Opening a bank account for a 16 year old is a great way to help them learn about money management and financial responsibility

The crucial difference between bank accounts for under 18s and those for adults is that you won’t have an overdraft facility, which lets you borrow money through your current account by taking out more than you have in there. That’s because bank accounts for teens have restrictions on lending (you have to be 18 or over to qualify for that). There might also be a limit on how much cash you can withdraw each day.

On the plus side, some of the best bank accounts for 16 years olds offer cool perks, such as discounts on driving lessons.

So if you don’t have an account go ahead and open one up ! Your money is safe and you will contribute in your own way to help those that are too big to fail !!

Leave a comment